In Bigger than the game, we looked at the size of the sports betting market in South Africa. Safe to say, it’s massive, yet it remains frustratingly opaque to analysts, investors and other brands also looking to capture a share of consumer spending.

So, let’s pull back the veil even further.

A key advantage of Slant’s research is our ability to break down spending. In any given month, the value of spend at a particular brand is made up of:

- The number of customers spending.

- The number of times each customer spends in the month.

- The average transaction value each time they spend.

Calculating spend value like this helps us break down how consumers engage with brands. Are there lots of customers paying small amounts, for example, or infrequent shoppers spending more each time?

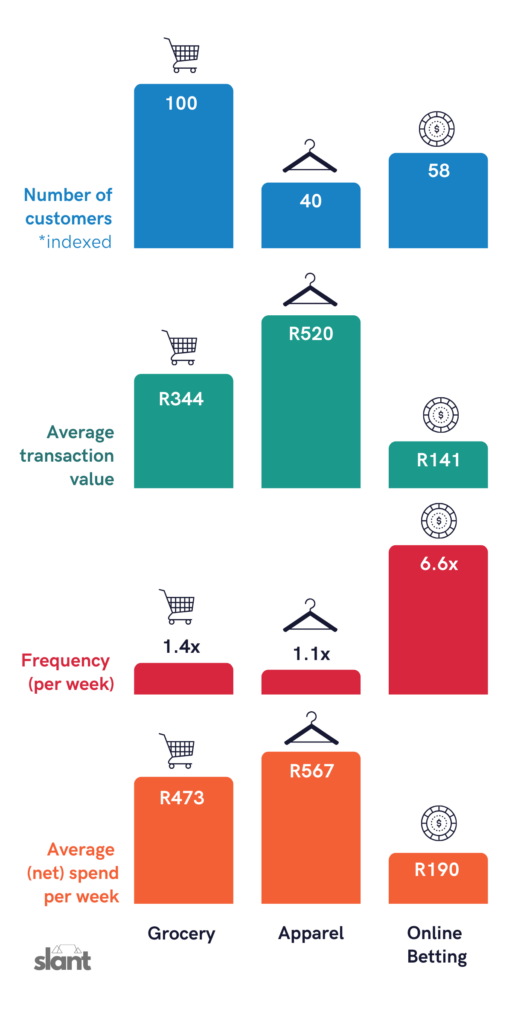

In the context of online betting, the results are extreme. How extreme? Well, to help contextualise our findings, we used this method to compare the largest grocery and clothing retailers in South African to the largest online betting brand.

Here’s the result:

Let’s unpack this chart. On average, if the largest grocery brand in the country attracted 100 customers in a week, the average customer would shop there 1.4 times and spend R344 each visit, for a weekly total grocery spend of R473.

Measured against that indexed metric, the largest apparel brand in our data would attract 40 customers per week. Those customers would spend more (R520 on average) but shop less frequently (1.1x), spending a net total of R567.

Then we have the largest online betting brand in the country. Going by the 100-customer metric, the betting brand attracts a staggering 58 customers per week, each of whom transacts a whopping 6.6 times at an average spend of R141 each time.

But it’s not one-way spending with betting. In the average week, about half of the customers who spend on betting receive money back (winnings or cash-outs), which is yet another point of engagement between the customer and the brand.

That’s nearly 10 times each week that customers are engaging with the largest online betting brand – compared to less than 1.4 times per week for the most habitual purchase that nearly all customers make.

Is there another South African business that has this extent of customer engagement?

Is this a good thing?

Probably not – if you look at the social issues. Many commentators have already pointed out the damage that online betting is creating. Some banks have even flagged online betting as an emerging problem eating away at the social fabric of society.

Given that banks are secondary beneficiaries of the extreme transaction volumes exposed in this analysis – compared to other consumer categories and not accounting for additional business banking and treasury-related services that must accompany online betting businesses – it will be interesting to see which banks side with social good, and which simply look at the bottom line…

How can our alternative data and research help you?