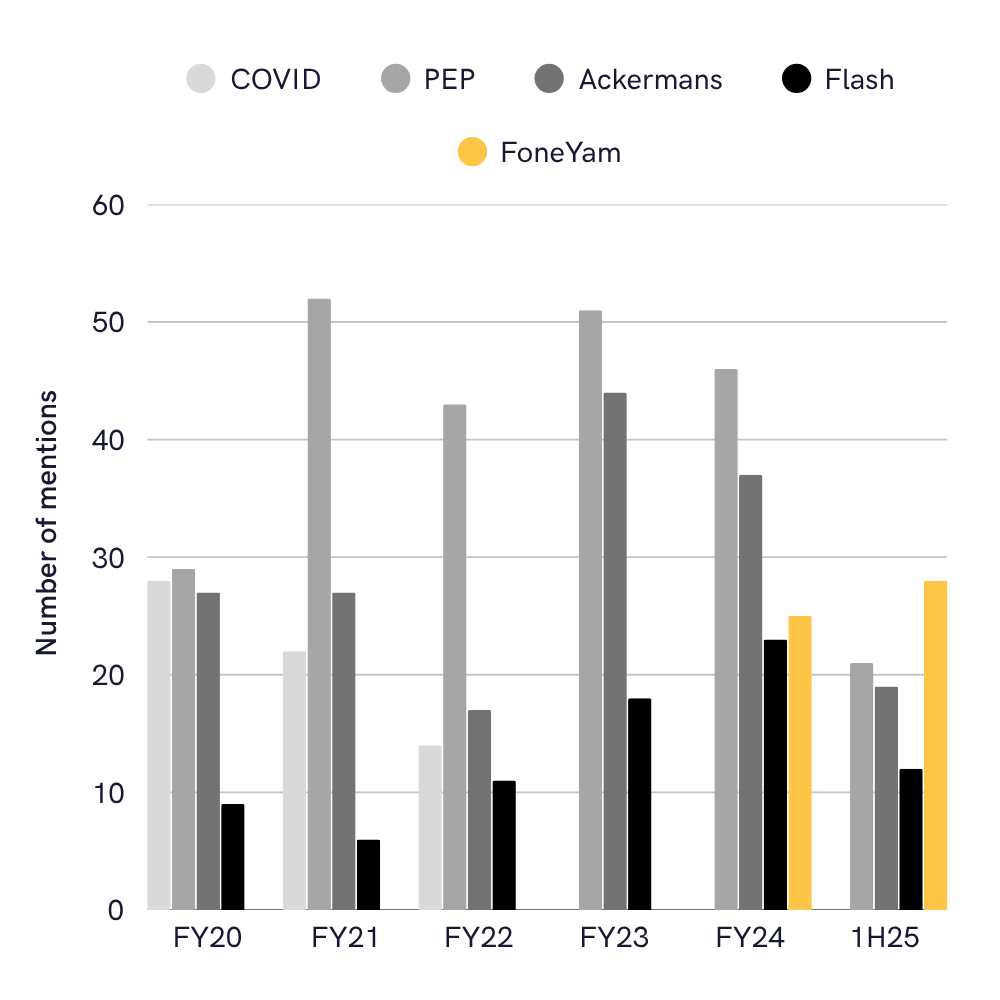

Not since ‘Covid’ has a word been mentioned more often in a Pepkor presentation than its major divisions, PEP and Ackermans. That’s what happened in the latest analyst presentation, and the word was ‘FoneYam’. Mentions surpassed PEP and Ackermans, and their high-growth fintech business, Flash.

Don’t believe us? Here’s a chart:

Word count in results transcripts

All the chatter shows just what an exciting prospect FoneYam is for the group, with revenue growth exceeding 100% and a book of more than R1.7bn in March 2025.

FoneYam is the group’s smartphone rental service. Based on the pricing calculator on the website, the model works as follows:

- Approved customers pay 30% of the device value upfront;

- 6% of the device value after seven days;

- And then 12 equal monthly instalments, calculated as such: remaining device value x 233.5% ([100 – 30 -6]x233.5% = 149%)

- Crucially, through clever use of software installed on the device, FoneYam can remotely lock the device if the customer fails to make any of these payments, or if they insert another SIM card.

- Free insurance is included in the agreement, which covers loss or theft of the device. There’s also death, disability and loss of income cover; if approved, the contract becomes void. Damage to the device is not covered.

In summary, based on the pricing formula at foneyam.co.za, customers end up paying 185% of the value of the phone over 12 months. According to Pepkor’s CFO, “FoneYam [Gross Margin] is slightly higher than what you would see in normal credit products.” (CFO, 1H25). Bit of a euphemism…

What’s the difference between a FoneYam rental agreement and purchasing the device on credit, plus device insurance?

It’s not just semantics. TikTokkers inform us that FoneYam roughly translates as “my phone” – ironic, since the T&Cs are clear that FoneYam is a rental agreement, provided by the group’s Tenacity business, and that the company retains ownership of the device. As a rental agreement, customer protection protocols under the National Credit Act, such as interest rate caps, do not apply. And unlike a traditional rental agreement, as for a property or for a vehicle, the customer pays back the full value of the asset during the rental period, plus more.

FoneYam therefore is not obliged to report any of its agreements and customer payment profiles to SACRRA and other credit bureaus for the benefit of industry credit checks, although it does warn customers that it may report “the manner in which [she] conducts [her] rental payments” to the credit bureaux (sic).”

The credit industry is already burdened by other credit-like products operating outside credit regulations, such as Buy Now, Pay Later (BNPL), which some argue create liabilities for the industry while not being held to the same obligations. Continued growth in this area is likely to draw scrutiny and further calls for regulation. That’s a multi-year concern for companies, but it’s something worth considering for analysts discounting earnings over long periods.

In this note, we:

- Analyse transaction values to infer device values;

- Investigate the cost of device insurance to calculate the cost of alternative financing solutions;

- Look at the demographics of customers taking up the FoneYam rental;

- Compare retention, or monthly pay-again rates, against other financing services;

- Review the airtime recharge habits of FoneYam customers (noting that the rental terms prevent SIM swapping) to evaluate Pepkor’s ongoing incentives and the mobile networks benefiting most from FoneYam.

Enter the Galaxy A05

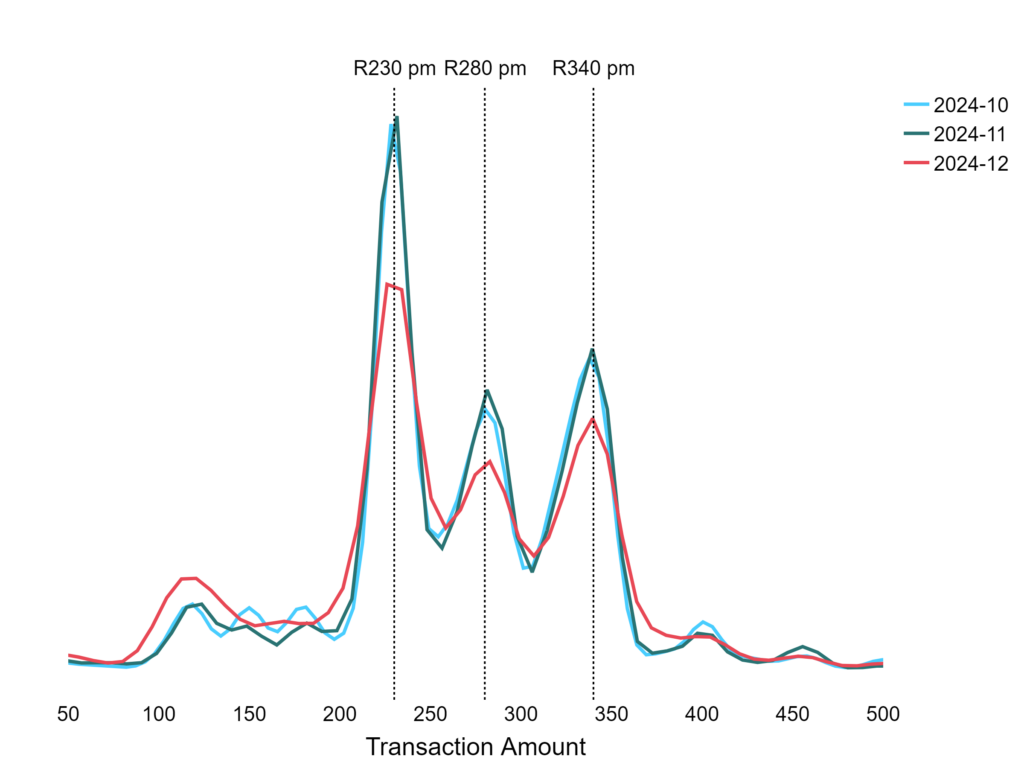

To start, we identified a sample of ~2,300 customers who made a FoneYam payment during the fourth quarter of 2024. Plotting the frequency of the various payment amounts – see below – shows that the most common amount is R230 pm, followed by R280, then R340. All else being equal, these values correspond to devices worth about R1,850, R2,250 and R2,730 respectively – the price of a Samsung Galaxy A05, A06 or similar.

Frequency and distribution of FoneYam payments by month

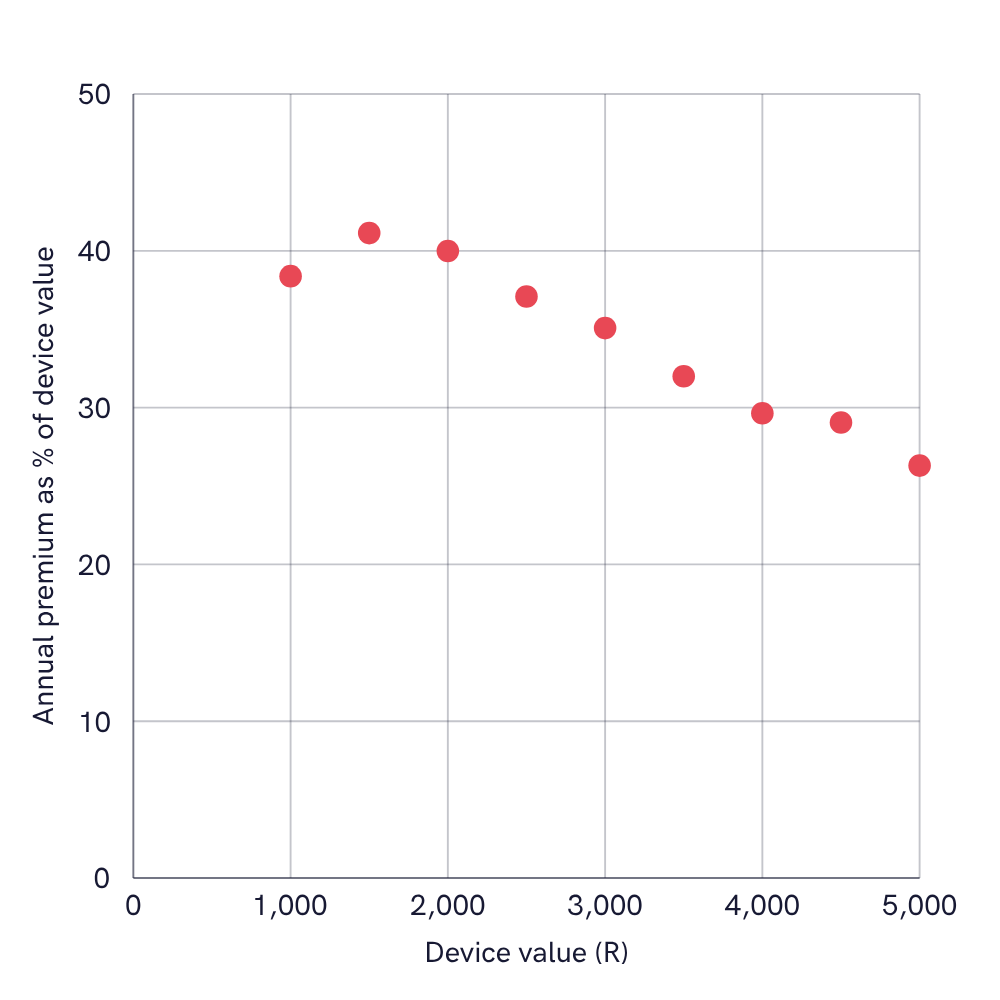

On the matter of insurance… In this device price range, according to Techsured – underwritten by Guardrisk and one of the more popular standalone insurance providers in our Insurance data set – the insurance cost is 35–40% of the value of the device.

Admittedly, FoneYam and Techsured do not offer like-for-like cover. A Techsured policy, for example, is typically for a customer-owned device and would cover damage (like a screen repair) as well as loss and theft.

FoneYam does not cover damage. We’re not insurance pricing experts, but damage is probably the most common incident claimed for in this category. The underlying cost of damage cover is likely to be the most significant component of this kind of policy.

The inference, therefore, is that FoneYam’s ‘free’ cover is likely to be lower than the range presented below.

Annual insurance premiums as percentage of device value (Techsured)

What’s the point of investigating the potential insurance costs involved in a FoneYam rental? Well, it helps us better understand the alternative financing option for a smartphone: a loan plus insurance. With interest rates capped at ~26% for this type of lending, and the cost of insurance at ~35%, the total cost of ownership in a 12-month period comes out at ~61% more than the price of the unit. Significantly, in this scenario, the customer owns the device at the end of the loan period, which they can sell if they wish to.

Our calculations put the cost of a FoneYam rental at 85% above the price of the unit, for the year: ~25% more than a normal credit agreement plus insurance and excluding the second-hand value of the device.

From the customer’s perspective, FoneYam is not an especially affordable smartphone financing option. Perhaps we’re underestimating the costs involved in offering this product? We think we’ve identified a major one, which we’ll unpack after identifying FoneYam customers in more detail…

You need to be logged in to read further.

If you are a client, please reset your password and login using your corporate e-mail address.

Slant offers solutions for investors, corporates and data partners. Click the button below to get in touch and find out how our alternative data and class-leading research can help you.