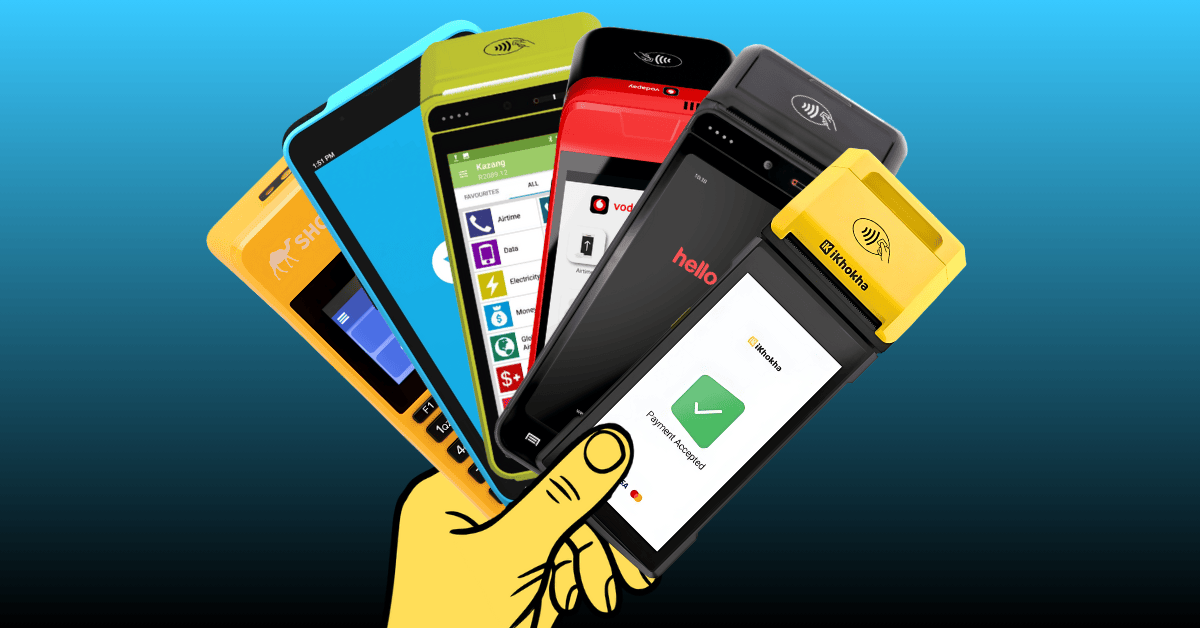

Last week, Nedbank announced its intention to acquire iKhokha for R1.65bn. As per the Nedbank description, iKhokha is “a South African fintech company that provides card machines, digital payment solutions, and business tools to SMEs.”

This is an important transaction in the fintech and point-of-sale (POS) space. It also draws even more attention to the card payment and devices market, where a number of start-ups have built solid businesses by combining innovation, low-cost payment devices, and business tools that have brought hundreds of thousands of SMEs into digital and ‘formal’ channels.

Capitec also recently signalled its intention to be disruptive in this space, leveraging its scale, innovation and pricing model to drive growth for its nascent business bank using payment devices.

The scale of the payments market highlights a number of connections with listed companies, some of which include:

- Most of the banks already have card-payment device offerings. Nedbank, for example, has ~110k devices in the market.

- Capital Appreciation’s African Resonance is one of the largest providers of payment devices.

- Vodacom’s VodaPay is a core offering of its business-to-business proposition.

- Lesaka owns Kazang; as well as the associated Card Connect, EasyPay, Adumo and most recently, Bank Zero.

- Capitec is rapidly growing its POS business, offering the lowest fees in the market.

- Pepkor’s CEO has a disclosed association with Shop2Shop.

Slant processes ~25 million transactions per month. We trawled through them to identify payments from multiple providers. Once we’d isolated the transactions, we estimated key metrics for each. Together with reported numbers for iKhokha, we believe that the detail provided here offers analysts valuable information to benchmark the valuation offered by Nedbank, and to derive estimates for the other device providers, some of which are holdings of listed businesses.

Let’s begin with a measure of the relative scale of the market in our data. Spoiler: it’s significant.

The chart below indexes the payment values processed by each of the providers in our analysis: iKhokha, HelloPay, Shop2Shop, Kazang, VPS and Yoco. We’ve split the data by the income bracket of the customers paying through the various terminals.

You need to be logged in to read further.

If you are a client, please reset your password and login using your corporate e-mail address.

Slant offers solutions for investors, corporates and data partners. Click the button below to get in touch and find out how our alternative data and class-leading research can help you.