Opinionated data.

We source and analyse alternative data to help investors and corporates act faster, be more creative and deliver better results.

Solutions for Investors

Learn more about investable consumer companies through differentiated research and in-depth sector data.

- Track top line.

- In-depth research of relevant investment-case assumptions.

- Identify emerging threats.

- Evaluate acquisitions of unlisted companies.

- Counter selective management disclosure.

- Increase conviction.

Solutions for Corporates

Monitor performance based on actual shopper purchases.

- Track market share weekly for unrivalled competitor intelligence.

- Break down market share into footfall, transaction frequency and spend patterns.

- Analyse purchasing behaviour between brands and across categories.

- Monitor customer retention and cross-shopping patterns.

Solutions for Data Partners

Unlock the commercial potential of your data using Slant’s insights-led research, which offers real, differentiated value to our clients.

- Explore joint ventures.

- Maximise the value of your data.

- Slant’s aggregation model removes personal information, which eliminates reputational risk.

- Benefit from the synergy of combining complementary datasets.

Categories we track

Grocery Retail

Apparel Retail

Online Betting

General Merchandise

Media

Transport

Eating Out

Telecoms

Liquor

Subscriptions

Latest Research

-

Stacking the odds

Who is funding the online betting boom?

-

Benchmark risk

Why Temu is Sixty60’s biggest threat.

-

Trend or trap?

Who is using Buy Now, Pay Later (BNPL) and how is it influencing consumer spending?

-

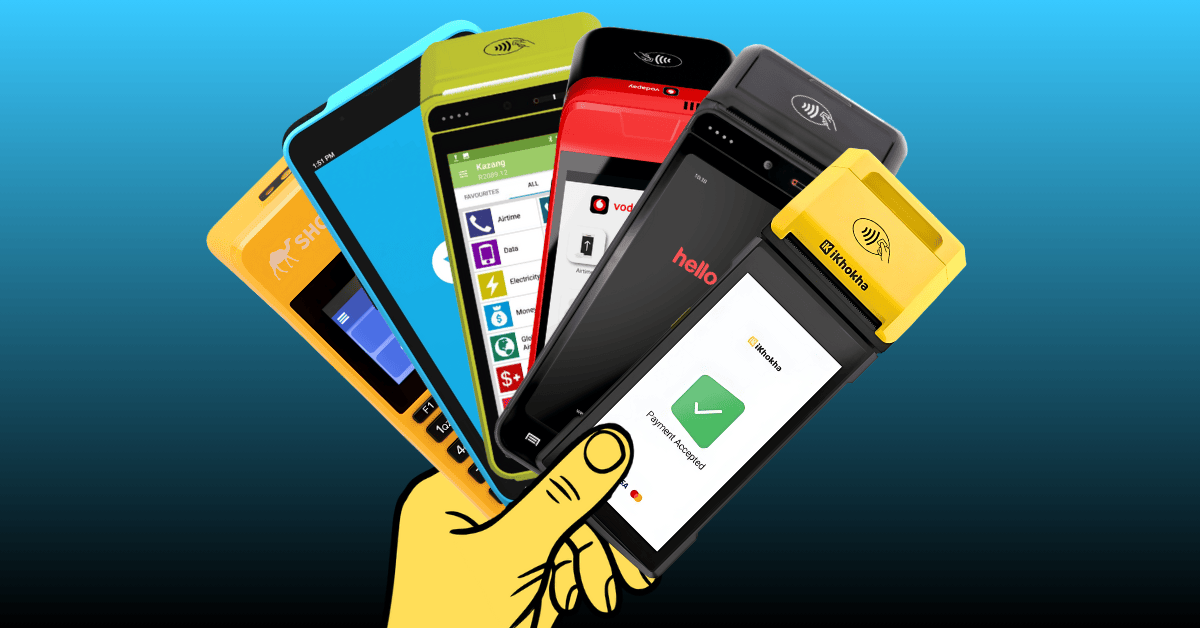

Payment poker

In the wake of Nedbank’s announcement to acquire iKhokha, we estimate the value of other payment providers.

-

The shape of things to come

How the shape of South Africa’s population pyramid might affect growth for listed retailers.

-

Liquid assets

The major grocery retailers have aggressively expanded their liquor store footprints. How much runway is left?